An example is a utility bill that has a fixed base charge plus a variable charge based on usage. For instance, a manufacturing plant may have a fixed monthly electricity charge plus additional costs that vary with production levels. Analyzing mixed costs can be more complex due to their dual nature, but it is essential for accurate differential cost analysis. By breaking down mixed costs into their fixed and variable components, businesses can better understand how these costs will change with different levels of activity and make more informed decisions. Fixed costs remain constant regardless of the level of production or business activity. These costs do not change in the short term and include expenses such as rent, salaries of permanent staff, and depreciation of equipment.

Understanding the Concept of Differential Cost: Types and Examples

In the next section, we will look at examples ofdifferential analysis. To illustrate relevant, differential, and sunkcosts, assume that Joanna Bennett invested $400 in a tiller so shecould till gardens to earn $1,500 during the summer. Not longafterward, Bennett was offered a job at a horse stable feedinghorses and cleaning stalls for $1,200 for the summer. The coststhat she would incur in tilling are $100 for transportation and$150 for supplies. The costs she would incur at the horse stableare $100 for transportation and $50 for supplies. If Bennett worksat the stable, she would still have the tiller, which she couldloan to her parents and friends at no charge.

Differential Cost vs. Opportunity Cost

The changes in costs are measured from a common base point which may be a present course of action or present level of production. It may be remembered that differential cost may be increase or decrease in costs. Suppose, present cost is Rs. 2,50,000 when the work is done by labour and the expected cost Rs. 2,25,000 when the work is done by machinery. Future costs that do not differ betweenalternatives are irrelevant and may be ignored since they affectboth alternatives similarly. Past costs, also known as sunkcosts, are not relevant in decision making because theyhave already been incurred; therefore, these costs cannot bechanged no matter which alternative is selected.

Difference between Marginal and Differential Costing

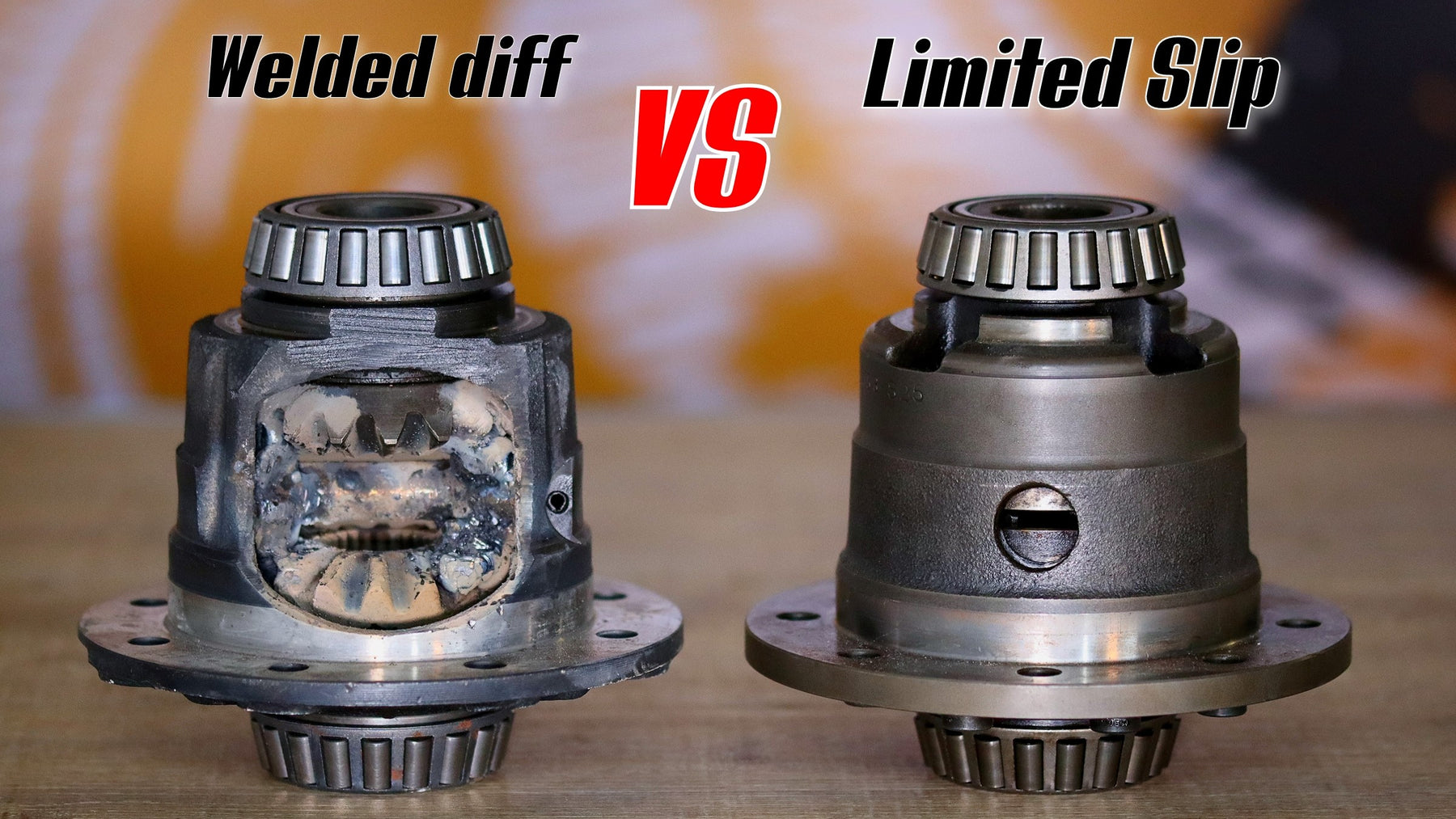

Differential cost may be referred to as either incremental cost or decremental cost. Managers also consider differential cost for equipment choices. Two machines might do the same job but have different maintenance and operation costs over time – these are indirect variable and fixed expenses related to running them each day. Differential costs might also be known as incremental or marginal costs, but they’re not exactly the same. Incremental cost specifically looks at changes due to an increase in production or activity level, while marginal cost relates to the cost of producing one additional unit. Our blog dives into the nuts and bolts of differential costs, helping you distinguish between variable, fixed, and semi-variable expenses.

Semi-variable Expenses

Short-term and long-term costs can differ significantly, and understanding this temporal dimension is essential for accurate decision-making. For instance, a decision that appears cost-effective in the short term may not be sustainable in the long run. Therefore, businesses must consider the duration over which the costs will be incurred and the happy 4th of potential for changes in cost structures over time. Businesses often face such choices and rely on comparative cost analysis to guide them. Put simply, they tally up extra costs like materials, labor or shipping that come with each option. Since a differential cost is only used for management decision making, there is no accounting entry for it.

From the above analysis, we can observe that with the change in the alternative, an entity will have to incur an additional cost of $1,000. Differential cost is a technique of decision-making in which the cost between various alternatives is compared and contrasted with choosing between the most competing alternative. It is useful when you want to understand a) Whether to process the product further or not and b) Whether to accept an additional order at a lower current price. The ascertainment of differential cost becomes easy if a flexible budget is prepared by the concern because it shows cost at various levels of activity.

A bed & breakfast inn owner uses differential analysis to decide whether to renovate a first-floor guest bedroom or to convert that space to a gift shop. A summary of the year’s revenues and costs for the two alternatives follows. Total differential costs are considered in differential cost analysis. Before studying the applications of differentialanalysis, you must realize that opportunity costs are also relevantin choosing between alternatives. An opportunity cost is thepotential benefit that is forgone by not following the next bestalternative course of action. Making the right choice between two products involves a close look at differential costs.

- Differential cost refers to the difference in total costs between two alternatives, encompassing all relevant costs that change as a result of the decision.

- Differential cost is the change in the costs which may take place due to increase or decrease in output, change in sales volume, alternate method of production, make or buy decisions, change in product mix etc.

- This approach requires sophisticated data analysis tools and real-time cost tracking, but the potential benefits in terms of increased profitability and market responsiveness are substantial.

- (i) Prepare a schedule showing the total differential costs and increments in revenue.

For example, an airline might use differential cost analysis to set ticket prices based on factors such as fuel costs, demand patterns, and competitor pricing. By continuously monitoring and adjusting prices, the airline can maximize revenue while ensuring that its pricing remains competitive. This approach requires sophisticated data analysis tools and real-time cost tracking, but the potential benefits in terms of increased profitability and market responsiveness are substantial. Once relevant costs are identified, the next step is to quantify these costs accurately. This often involves gathering data from various departments within the organization, such as procurement, production, and finance.

Irrelevant costs, such as sunk costs, should be excluded from the analysis as they do not influence the future outcomes of the decision. This distinction is crucial for maintaining the accuracy and relevance of the analysis. Real-world applications illuminate the theory—consider how businesses determine the best route when faced with alternative choices in production or service delivery.